Multiple Choice

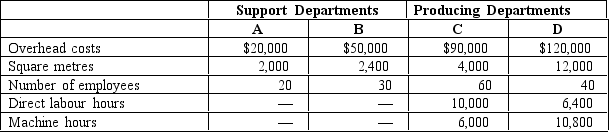

Lopez Manufacturing prices its products at full cost plus 40 percent.The company operates two support departments and two producing departments.Budgeted costs and normal activity levels are as follows:  Support Department A's costs are allocated based on square metres,and Support Department B's costs are allocated based on number of employees.Department C uses direct labour hours to assign overhead costs to products,while Department D uses machine hours.

Support Department A's costs are allocated based on square metres,and Support Department B's costs are allocated based on number of employees.Department C uses direct labour hours to assign overhead costs to products,while Department D uses machine hours.

One of the products the company produces requires 4 direct labour hours per unit in Department C and no time in Department D.Direct materials for the product cost $45 per unit,and direct labour is $20 per unit.

If the direct method of allocation is used and the company follows its usual pricing policy,what would be the selling price of the product?

A) $102.00

B) $111.00

C) $115.00

D) $161.00

Correct Answer:

Verified

Correct Answer:

Verified

Q77: A company incurred $40,000 of common

Q78: Consider the following statement: Overall sales revenue

Q79: Yo Department Store incurred $4,000 of

Q80: Newton Company has two support departments,

Q81: Staff Company allocates common Building Department

Q83: Plants Company has two support departments

Q84: Deli Products produces two products,X and Y,in

Q85: Alpha Company’s travel department had the

Q86: A company incurred $40,000 of common

Q87: Which of the following industries would most