Multiple Choice

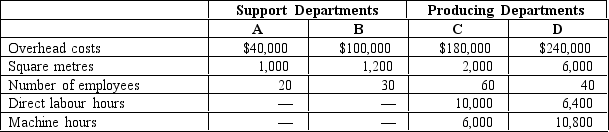

Jin Manufacturing prices its products at full cost plus 30 percent.The company operates two support departments and two producing departments.Budgeted costs and normal activity levels are as follows:  Support Department A's costs are allocated based on square metres,and Support Department B's costs are allocated based on number of employees.

Support Department A's costs are allocated based on square metres,and Support Department B's costs are allocated based on number of employees.

Department C uses direct labour hours to assign overhead costs to products,while Department D uses machine hours.

One of the products the company produces requires 4 direct labour hours per unit in Department C and no time in Department D.Direct materials for the product cost $180 per unit,and direct labour is $80 per unit.

If the direct method of allocation is used and the company follows its usual pricing policy,what would be the selling price of the product?

A) $260.00

B) $332.00

C) $431.60

D) $468.00

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Staff Company allocates common Building Department

Q14: What is the purpose of support departments?<br>A)They

Q15: Wilson and Lewis,a large law firm,utilizes an

Q16: What should fixed support department costs allocation

Q17: The following information pertains to Utter Company:

Q20: When does a common cost occur?<br>A)when only

Q21: Oaks Company has two support departments,

Q22: Oaks Company has two support departments,

Q23: Yo Department Store incurred $4,000 of

Q94: Describe the differences between the direct, sequential