Essay

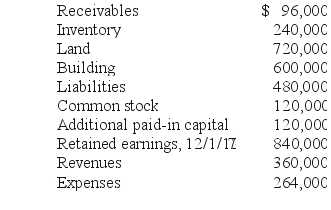

Jernigan Corp.had the following account balances at 12/1/17:

Several of Jernigan's accounts have fair values that differ from book value.The fair values are: Land - $480,000; Building - $720,000; Inventory - $336,000; and Liabilities - $396,000.

Several of Jernigan's accounts have fair values that differ from book value.The fair values are: Land - $480,000; Building - $720,000; Inventory - $336,000; and Liabilities - $396,000.

Inglewood Inc.acquired all of the outstanding common shares of Jernigan by issuing 20,000 shares of common stock having a $6 par value per share, but a $66 fair value per share.Stock issuance costs amounted to $12,000.

Required:

Prepare a fair value allocation and goodwill schedule at the date of the acquisition.

Correct Answer:

Verified

Correct Answer:

Verified

Q21: How are bargain purchases accounted for in

Q77: Compute the consolidated receivables and inventory for

Q79: Compute consolidated inventory immediately following the acquisition.<br>A)

Q80: On January 1, 2018, Chester Inc.acquired 100%

Q81: With respect to recognizing and measuring the

Q83: Compute the consolidated common stock at the

Q84: Compute fair value of the net assets

Q85: Assume that Bullen issued 12,000 shares of

Q86: Compute the consolidated expenses for 2018.<br>A) $1,980.<br>B)

Q87: Assume that Bullen paid a total of