Short Answer

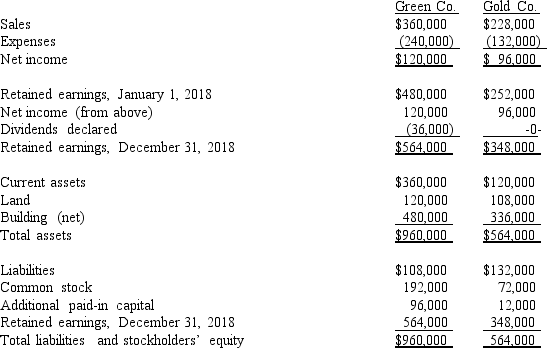

The following are preliminary financial statements for Green Co.and Gold Co.for the year ending December 31, 2018 prior to Black's acquisition of Blue.

On December 31, 2018 (subsequent to the preceding statements), Green exchanged 10,000 shares of its $10 par value common stock for all of the outstanding shares of Gold.Green's stock on that date has a fair value of $60 per share.Green was willing to issue 10,000 shares of stock because Gold's land was appraised at $204,000.Green also paid $14,000 to attorneys and accountants who assisted in creating this combination.

On December 31, 2018 (subsequent to the preceding statements), Green exchanged 10,000 shares of its $10 par value common stock for all of the outstanding shares of Gold.Green's stock on that date has a fair value of $60 per share.Green was willing to issue 10,000 shares of stock because Gold's land was appraised at $204,000.Green also paid $14,000 to attorneys and accountants who assisted in creating this combination.

Required:

Assuming that these two companies retained their separate legal identities, prepare a consolidation worksheet as of December 31, 2018 after the acquisition transaction is completed.

Correct Answer:

Verified

(1) I; (2)...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Compute consolidated expenses immediately following the acquisition.<br>A)

Q3: Assuming the combination occurred prior to 2009

Q5: In an acquisition where 100% control is

Q6: Prepare the journal entries to record: (1)

Q7: Compute the consolidated cash account at December

Q8: Compute the amount of consolidated inventories at

Q9: The following are preliminary financial statements for

Q10: Compute the amount of consolidated equipment at

Q11: Compute the consolidated revenues for 2018.<br>A) $2,700.<br>B)

Q33: Lisa Co. paid cash for all of