Essay

On January 1, 2016, Rand Corp.issued shares of its common stock to acquire all of the outstanding common stock of Spaulding Inc.Spaulding's book value was only $140,000 at the time, but Rand issued 12,000 shares having a par value of $1 per share and a fair value of $20 per share.Rand was willing to convey these shares because it felt that buildings (ten-year life) were undervalued on Spaulding's records by $60,000 while equipment (five-year life) was undervalued by $25,000.Any consideration transferred over fair value of identified net assets acquired is assigned to goodwill.

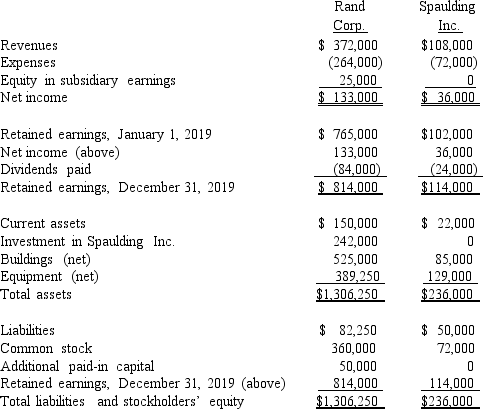

Following are the individual financial records for these two companies for the year ended December 31, 2019.

Required:

Required:

Prepare a consolidation worksheet for this business combination.

Correct Answer:

Verified

Consolidation Worksheet for Ra...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q30: If Watkins pays $450,000 in cash for

Q32: When a company applies the initial value

Q34: Assume the equity method is applied.How much

Q35: For an acquisition when the subsidiary retains

Q35: What is the balance in Cale's investment

Q36: Compute the December 31, 2020 consolidated retained

Q38: Compute the amount of Hurley's long-term liabilities

Q47: Yules Co. acquired Noel Co. and applied

Q53: What should an entity evaluate when making

Q76: Under the initial value method, when accounting