Essay

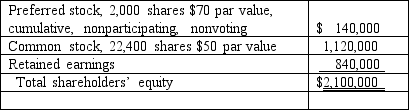

On January 1, 2018, Bast Co.had a net book value of $2,100,000 as follows:

Fisher Co.acquired all of the outstanding preferred shares for $148,000 and 60% of the common stock for $1,281,000.Fisher believed that one of Bast's buildings, with a twelve-year life, was undervalued on the company's financial records by $70,000.

Fisher Co.acquired all of the outstanding preferred shares for $148,000 and 60% of the common stock for $1,281,000.Fisher believed that one of Bast's buildings, with a twelve-year life, was undervalued on the company's financial records by $70,000.

Required:

What is the amount of goodwill to be recognized from this purchase?

Correct Answer:

Verified

Correct Answer:

Verified

Q36: Which of the following statements is false

Q39: What are the primary sources of information

Q40: If a subsidiary re-acquires its outstanding shares

Q55: Where do dividends paid by a subsidiary

Q73: Parent Corporation recently acquired some of its

Q84: During 2018, Parent Corporation purchased at carrying

Q91: On January 1, 2019, Cocker issued 10,000

Q98: How are intra-entity inventory transfers treated on

Q112: The accounting problems encountered in consolidated intra-entity

Q118: Which of the following statements regarding consolidation