Essay

Jet Corp.acquired all of the outstanding shares of Nittle Inc.on January 1, 2016, for $644,000 in cash.Of this consideration transferred, $42,000 was attributed to equipment with a ten-year remaining useful life.Goodwill of $56,000 had also been identified.Jet applied the partial equity method so that income would be accrued each period based solely on the earnings reported by the subsidiary.

On January 1, 2019, Jet reported $280,000 in bonds outstanding with a book value of $263,200.Nittle purchased half of these bonds on the open market for $135,800.

During 2019, Jet began to sell merchandise to Nittle.During that year, inventory costing $112,000 was transferred at a price of $140,000.All but $14,000 (at Jet's selling price) of these goods were resold to outside parties by year's end.Nittle still owed $50,400 for inventory shipped from Jet during December.

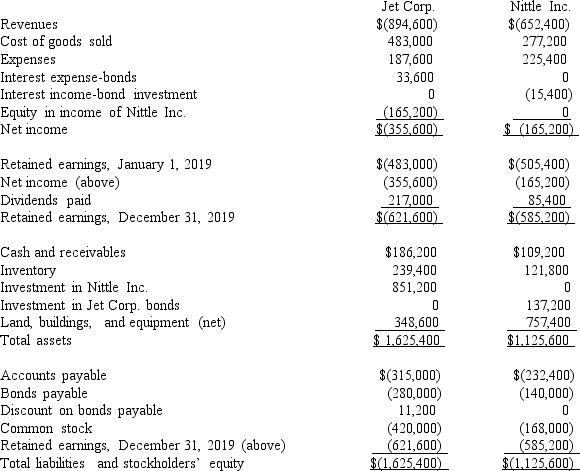

The following financial figures were for the two companies for the year ended December 31, 2019.

Required:

Required:

Prepare a consolidation worksheet for the year ended December 31, 2019.

Correct Answer:

Verified

CONSOLIDATION WORKSH...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q19: Where do intra-entity transfers of inventory appear

Q30: What is the adjusted book value of

Q31: Using the indirect method, where does the

Q35: What is the adjusted book value of

Q36: Which of the following statements is true

Q37: What was Kuried's balance in the Investment

Q39: Parker owned all of Odom Inc.Although the

Q44: Where do dividends paid to the noncontrolling

Q45: Which of the following characteristics is not

Q91: Which of the following is not a