Essay

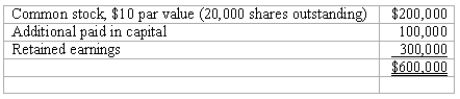

Panton, Inc.acquired 18,000 shares of Glotfelty Corp.several years ago for $30 per share when Glotfelty had a book value of $450,000.Before and after that time, Glotfelty's stock traded at $30 per share.At the present time, Glotfelty reports the following stockholders' equity:  Glotfelty issues 5,000 shares of previously unissued stock to Panton for $35 per share.

Glotfelty issues 5,000 shares of previously unissued stock to Panton for $35 per share.

Required: Describe how this transaction would affect Panton's books.

Correct Answer:

Verified

The investment account and APIC will be ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: Prepare Panton's journal entry to recognize the

Q42: How do outstanding subsidiary stock warrants affect

Q56: Which of the following is not a

Q86: Which one of the following characteristics of

Q105: What should the adjusted book value of

Q106: Net cash flow from financing activities was:<br>A)

Q111: What is the new percent ownership of

Q112: On January 1, 2019, Cocker reacquired 8,000

Q113: In preparing the consolidation worksheet as of

Q114: Carlson, Inc.owns 80 percent of Madrid, Inc.Carlson