Multiple Choice

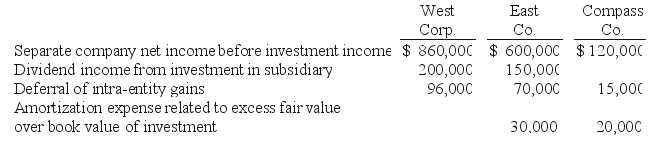

-For West Corp.and consolidated subsidiaries, what total amount would be reported for the net income attributable to the noncontrolling interest?

A) $165,300.

B) $199,300.

C) $191,000.

D) $228,000.

E) $153,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q21: How is goodwill amortized?<br>A) It is not

Q53: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2563/.jpg" alt=" -The accrual-based net

Q55: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2563/.jpg" alt=" -What is Alpha's

Q56: B Co.owned 70% of the voting common

Q59: Why might a consolidated group file separate

Q60: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2563/.jpg" alt=" -Compute the net

Q60: C Co. currently owns 80% of D

Q63: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2563/.jpg" alt=" -The accrual-based net

Q83: Explain how the treasury stock approach treats

Q90: Which of the following statements is true