Multiple Choice

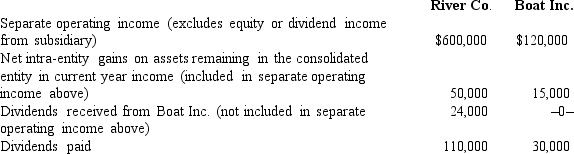

-The amount of income tax expense that should be assigned to Boat using the separate return method is approximately:

A) $36,000

B) $31,500

C) $33,390

D) $32,750

E) $32,660

Correct Answer:

Verified

Correct Answer:

Verified

Q46: D Corp. had investments, direct and indirect,

Q77: Which of the following conditions will allow

Q96: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2563/.jpg" alt=" -What is Delta's

Q97: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2563/.jpg" alt=" -What is the

Q98: When Buckette prepares consolidated financial statements, it

Q99: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2563/.jpg" alt=" -What is Pi's

Q103: Reggie, Inc.owns 70 percent of Nancy Corporation.During

Q105: Required:<br>Determine the net income attributable to the

Q106: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2563/.jpg" alt=" -What is the

Q112: X Co. owned 80% of Y Corp.,