Multiple Choice

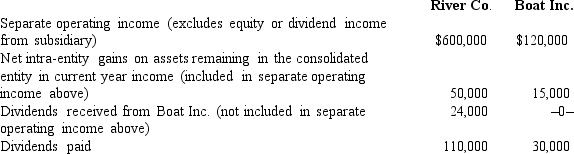

-What was the net income attributable to the noncontrolling interest, assuming that the separate return method was used to assign the income tax expense?

A) $16,800

B) $14,450

C) $14,700

D) $17,450

E) $13,800

Correct Answer:

Verified

Correct Answer:

Verified

Q16: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2563/.jpg" alt=" -The accrual-based net

Q17: Required:<br>Under the treasury stock approach, what is

Q18: Compute Lawrence's accrual-based net income for 2018.<br>A)

Q20: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2563/.jpg" alt=" -What is the

Q22: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2563/.jpg" alt=" -Compute Whitton's accrual-based

Q23: Assuming that separate income tax returns are

Q26: What configuration of corporate ownership is described

Q61: Which of the following is true concerning

Q73: When indirect control is present, which of

Q123: Which of the following statements is false