Multiple Choice

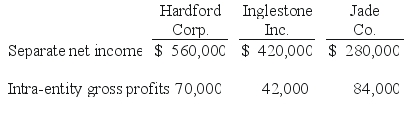

Hardford Corp. held 80% of Inglestone Inc., which, in turn, owned 80% of Jade Co. Excess amortization expense was not required by any of these acquisitions. Separate net income figures (without investment income) as well as upstream intra-entity gross profits (before deferral) included in the income for the current year follow:

-The accrual-based net income of Jade Co.is calculated to be

A) $193,000.

B) $189,000.

C) $196,000.

D) $201,000.

E) $144,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q14: Evanston Co. owned 60% of Montgomery Corp.

Q74: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2563/.jpg" alt=" -What is the

Q75: White Company owns 60% of Cody Company.

Q76: Hardford Corp. held 80% of Inglestone Inc.,

Q78: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2563/.jpg" alt=" -What is the

Q80: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2563/.jpg" alt=" -Compute the amount

Q81: Required:<br>Under the treasury stock approach, what is

Q82: Hardford Corp. held 80% of Inglestone Inc.,

Q92: Under current U.S. tax law for consolidated

Q95: Woods Company has one depreciable asset valued