Multiple Choice

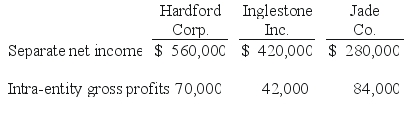

Hardford Corp. held 80% of Inglestone Inc., which, in turn, owned 80% of Jade Co. Excess amortization expense was not required by any of these acquisitions. Separate net income figures (without investment income) as well as upstream intra-entity gross profits (before deferral) included in the income for the current year follow:

-Which of the following statements is true regarding a subsidiary's investment in the parent company's stock?

A) The treasury stock approach focuses on the parent's control over its subsidiary.

B) For consolidation, both the parent and subsidiary must defer gross profit on remaining inventory from intra-entity transfers.

C) In consolidation, the parent's retained earnings will not be reduced by the dividends it paid to the subsidiary.

D) This corporate combination is known as mutual ownership.

E) All of these answer choices are true statements.

Correct Answer:

Verified

Correct Answer:

Verified

Q27: What ownership pattern is referred to as

Q33: How is the amortization of goodwill treated

Q37: In a father-son-grandson combination, which of the

Q44: On January 1, 2018, Youder Inc.bought 120,000

Q45: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2563/.jpg" alt=" -The accrual-based net

Q46: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2563/.jpg" alt=" -What is the

Q50: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2563/.jpg" alt=" -What is Beta's

Q52: Required:<br>Determine the total amount of goodwill for

Q53: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2563/.jpg" alt=" -The accrual-based net

Q83: Explain how the treasury stock approach treats