Multiple Choice

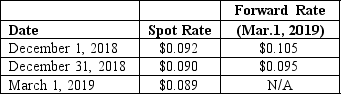

On December 1, 2018, Joseph Company, a U.S.company, entered into a three-month forward contract to purchase 50,000 pesos on March 1, 2019, as a fair value hedge of a foreign currency denominated account payable.The following U.S.dollar per peso exchange rates apply:  Joseph's incremental borrowing rate is 12 percent.The present value factor for two months at an annual interest rate of 12 percent is .9803.Which of the following is included in Joseph's December 31, 2018 balance sheet for the forward contract?

Joseph's incremental borrowing rate is 12 percent.The present value factor for two months at an annual interest rate of 12 percent is .9803.Which of the following is included in Joseph's December 31, 2018 balance sheet for the forward contract?

A) $5,146.58 asset.

B) $5,146.58 liability.

C) $ 500.00 liability.

D) $ 490.15 asset.

E) $ 490.15 liability.

Correct Answer:

Verified

Correct Answer:

Verified

Q14: Which of the following approaches is used

Q26: A U.S. company sells merchandise to a

Q53: What happens when a U.S. company purchases

Q71: What was the impact on Mosby's 2018

Q73: What journal entry should Eagle prepare on

Q74: What amount will Coyote Corp.report in its

Q75: What was the overall result of having

Q77: What was the net increase or decrease

Q81: Which of the following statements is true

Q102: Which of the following is not a