Multiple Choice

A U.S.company's foreign subsidiary had the following amounts in stickles (§) in 2018:  The average exchange rate during 2018 was §1 = $.96.The beginning inventory was acquired when the exchange rate was §1 = $1.20.The ending inventory was acquired when the exchange rate was §1 = $.90.The exchange rate at December 31, 2018 was §1 = $.84.Assuming that the foreign country had a highly inflationary economy, at what amount should the foreign subsidiary's cost of goods sold have been reflected in the 2018 U.S.dollar income statement?

The average exchange rate during 2018 was §1 = $.96.The beginning inventory was acquired when the exchange rate was §1 = $1.20.The ending inventory was acquired when the exchange rate was §1 = $.90.The exchange rate at December 31, 2018 was §1 = $.84.Assuming that the foreign country had a highly inflationary economy, at what amount should the foreign subsidiary's cost of goods sold have been reflected in the 2018 U.S.dollar income statement?

A) $11,253,600.

B) $11,577,600.

C) $11,649,600.

D) $11,613,600.

E) $11,523,600.

Correct Answer:

Verified

Correct Answer:

Verified

Q32: The financial statements for Perez are remeasured

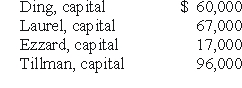

Q34: Compute the cost of goods sold for

Q35: Prepare a balance sheet for this subsidiary

Q37: In translating a foreign subsidiary's financial statements,

Q38: Assume the functional currency is the U.S.Dollar;

Q39: Perkle Co.owned a subsidiary in Belgium; the

Q40: Kennedy's share of Hastie's net income for

Q41: Assume the functional currency is the U.S.Dollar;

Q44: Under the current rate method, which accounts

Q52: Which method of translating a foreign subsidiary's