Essay

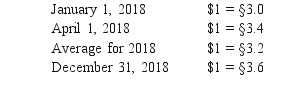

On January 1, 2018, Fandu Corp.began operations of a foreign subsidiary.On April 1, 2018, the subsidiary purchased inventory costing 150,000 stickles.One-fourth of this inventory remained unsold at the end of 2018 while 40% of the liability from the purchase had not yet been paid.The pertinent indirect exchange rates were:

Required:

Required:

What should have been the December 31, 2018 inventory and accounts payable balances for this foreign subsidiary as translated into U.S.dollars? (Round your answers to the nearest whole dollar.)

Correct Answer:

Verified

Correct Answer:

Verified

Q27: A net liability balance sheet exposure exists

Q71: Contrast the purpose of remeasurement with the

Q83: What exchange rate should have been used

Q84: Assume the functional currency is the Euro;

Q85: Sinkal Co.was formed on January 1, 2018

Q87: What was the amount of the translation

Q91: Assume the functional currency is the U.S.Dollar;

Q92: The financial statements for Perez are translated

Q93: A U.S.company's foreign subsidiary had the following

Q94: What exchange rate should be used to