Essay

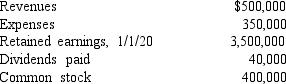

McLaughlin, Inc.acquires 70 percent of Ellis Corporation on September 1, 2019, and an additional 10 percent on November 1, 2020.Annual amortization of $12,000 relates to the first acquisition.Ellis reports the following figures for 2020:

Without regard for this investment, McLaughlin earns $480,000 in net income ($840,000 revenues less $360,000 expenses; incurred evenly through the year) during 2020.

Without regard for this investment, McLaughlin earns $480,000 in net income ($840,000 revenues less $360,000 expenses; incurred evenly through the year) during 2020.

Required: Prepare a schedule of consolidated net income and apportionment to noncontrolling and controlling interests for 2020.

Correct Answer:

Verified

* Amortization of ...

* Amortization of ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q17: Compute the noncontrolling interest in Demers at

Q20: Compute the noncontrolling interest in the net

Q45: How would you determine the amount of

Q63: Prepare a proper presentation of consolidated net

Q66: What are the total consolidated current liabilities

Q76: In consolidation at December 31, 2019, what

Q97: Compute the noncontrolling interest in Demers at

Q103: Alonzo Co.acquired 60% of Beazley Corp.by paying

Q104: In consolidation at January 1, 2019, what

Q114: Compute Pell's investment in Demers at December