Essay

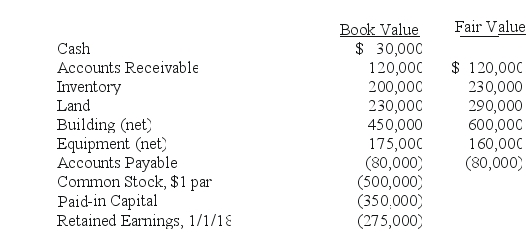

On January 1, 2018, Chester Inc.acquired 100% of Festus Corp.'s outstanding common stock by exchanging 37,500 shares of Chester's $2 par value common voting stock.On January 1, 2018, Chester's voting common stock had a fair value of $40 per share.Festus' voting common shares were selling for $6.50 per share.Festus' balances on the acquisition date, just prior to acquisition are listed below.

Required:

Required:

Compute the value of Goodwill on the date of acquisition, 1/1/18.

Correct Answer:

Verified

Fair value of consideration transferred:...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Compute consolidated expenses immediately following the acquisition.<br>A)

Q10: Compute the amount of consolidated equipment at

Q20: Compute the consideration transferred for this acquisition

Q61: If Osorio retains a separate corporate existence,

Q62: Jernigan Corp.had the following account balances at

Q73: Compute consolidated retained earnings as a result

Q76: Compute the consolidated retained earnings at December

Q77: Compute the consolidated receivables and inventory for

Q108: Acquired in-process research and development is considered

Q110: Determine consolidated Additional Paid-In Capital at December