Multiple Choice

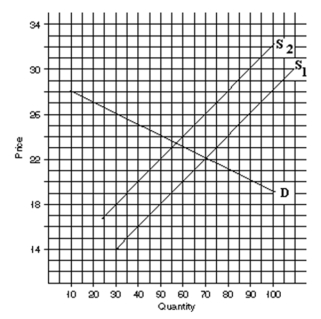

-About how much of the tax is paid by consumers in the form of higher prices?

A) $1.00

B) $1.35

C) $1.65

D) $2.00

E) $4.00

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q64: If an increase in price leads to

Q65: When demand is elastic,<br>A)the percentage change in

Q66: Which is NOT a determinant of the

Q67: Which statement is true?<br>A)A perfectly elastic demand

Q69: Demand is elastic if elasticity is greater

Q70: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5852/.jpg" alt=" -In the demand

Q71: Which statement is false?<br>A)The most important determinant

Q72: Statement I: A tax increase on a

Q73: Total revenue will rise if<br>A)demand for a

Q190: The consumer will pay for _ of