Essay

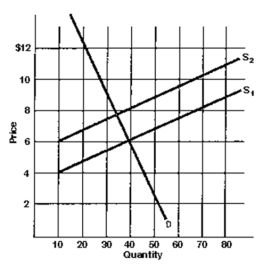

A.How much is the tax in the above graph?

B.How much of this tax is borne by the buyer and how much is borne by the seller?

C.As a result of the tax, by about how much does consumption fall?

Correct Answer:

Verified

(a) $2

(b) buyers pa...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

(b) buyers pa...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q72: Statement I: A tax increase on a

Q73: Total revenue will rise if<br>A)demand for a

Q112: When demand is elastic<br>A)the percentage change in

Q134: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5852/.jpg" alt=" -How much is

Q141: When two goods are complementary goods,as the

Q152: If elasticity of demand is 5 and

Q191: The demand for hamburger buns is known

Q192: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5852/.jpg" alt=" -Which statement

Q210: When demand is elastic,if we were to

Q228: The demand for goods such as heart