Short Answer

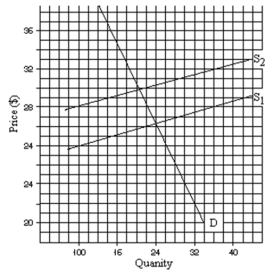

In graph: (a) How much is the tax? (b) How much of this tax is borne by the buyer? (c) How much of this tax is borne by the seller?

Correct Answer:

Verified

(a) $4.00

...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: Which statement is true?<br>A)Sales of kosher foods

Q65: When demand is elastic,<br>A)the percentage change in

Q78: Demand is inelastic if<br>A)the percentage change in

Q110: In the graph above, draw a supply

Q110: If the elasticity coefficient is greater than

Q117: When elasticity is 0.1, demand is<br>A)elastic.<br>B)inelastic.<br>C)unit elastic.<br>D)undefined.

Q118: In the space provided in the graph

Q120: Use the following figure to answer the

Q169: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5852/.jpg" alt=" -How much

Q229: When the cross elasticity of demand is