Multiple Choice

Use the table for the question(s) below.

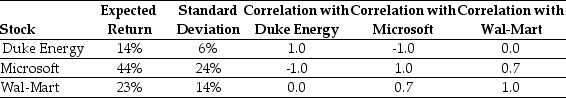

Consider the following expected returns, volatilities, and correlations:

-Consider a portfolio consisting of only Duke Energy and Microsoft.The percentage of your investment (portfolio weight) that you would place in Duke Energy stock to achieve a risk-free investment would be closest to:

A) 15%

B) 4%

C) 23%

D) 10%

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Which of the following statements is false?<br>A)

Q30: Both conservative and aggressive investors will choose

Q43: Suppose that you want to maximize your

Q51: Which of the following statements is false?<br>A)

Q52: Which of the following equations is incorrect?<br>A)

Q55: Which of the following statements is false?<br>A)

Q56: The relationship between risk and return for

Q77: Use the table for the question(s) below.<br>Consider

Q101: Which of the following statements is false?<br>A)

Q110: Use the information for the question(s)below.<br>Suppose you