Multiple Choice

Use the table for the question(s) below.

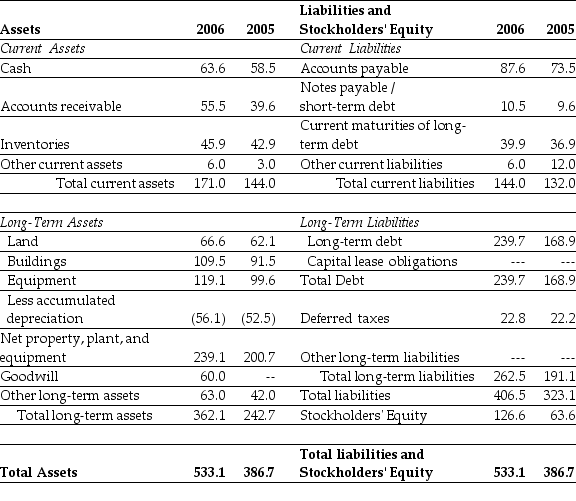

Consider the following balance sheet:

-If in 2006 Luther has 10.2 million shares outstanding and these shares are trading at $16 per share,then Luther's market-to-book ratio would be closest to:

A) 0.39

B) 0.76

C) 1.29

D) 2.57

Correct Answer:

Verified

Correct Answer:

Verified

Q45: What is the role of an auditor

Q52: As the Bernard Madoff's Ponzi Scheme makes

Q53: Which of the following statements regarding the

Q54: Depreciation is _ that the firm _.<br>A)

Q55: Use the table for the question(s) below.<br>Consider

Q56: Canadian public companies are required to file

Q58: Use the table for the question(s) below.<br>Consider

Q59: The P/E ratio is not useful when

Q62: Use the table for the question(s) below.<br>Consider

Q80: Cash is a:<br>A)long-term asset.<br>B)current asset.<br>C)current liability.<br>D)long-term liability.