Multiple Choice

Use the table for the question(s) below.

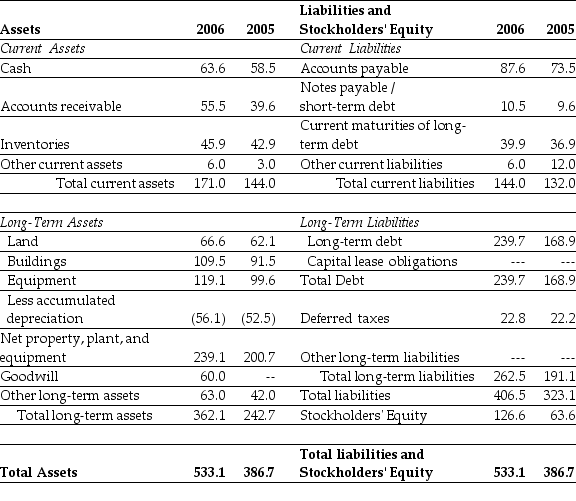

Consider the following balance sheet:

-When using the book value of equity,the debt to equity ratio for Luther in 2006 is closest to:

A) 2.21

B) 2.29

C) 2.98

D) 3.03

Correct Answer:

Verified

Correct Answer:

Verified

Q29: As of January 1,2011,Canadian publicly accountable companies

Q30: Creditors often compare a firm's _ and

Q31: Details of acquisitions,spin-offs,leases,taxes,and risk management activities are

Q32: Why does a firm's net income not

Q34: The change in Luther's quick ratio from

Q36: Management is also required to disclose any

Q37: Shareholders' equity,the difference between the firm's _,is

Q38: DuPont Identity expresses the ROE in terms

Q71: Which of the following is NOT a

Q83: Accounts payable is a:<br>A)long-term liability.<br>B)current asset.<br>C)long-term asset.<br>D)current