Essay

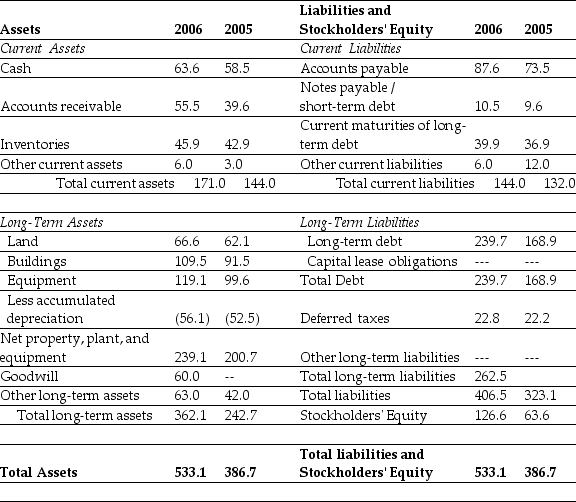

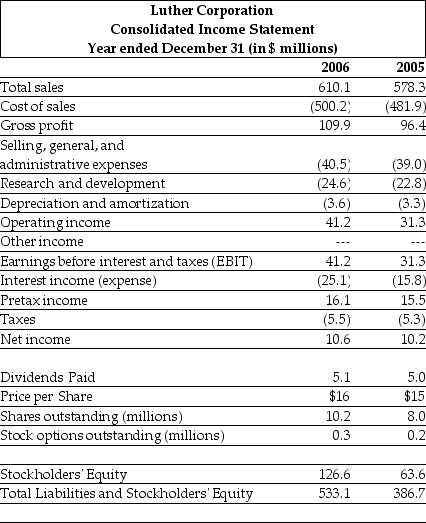

Use the tables for the question(s) below.

Consider the following financial information:

-Calculate Luther's cash flow from operating activities for the year ending December 31,2006.

Correct Answer:

Verified

Operating cash flow = NI + Dep...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q37: Shareholders' equity,the difference between the firm's _,is

Q38: DuPont Identity expresses the ROE in terms

Q39: Use the table for the question(s) below.<br>Consider

Q40: If in 2006 Luther has 10.2 million

Q41: What information do the notes to financial

Q43: The debt-to-equity ratio is calculated by dividing

Q44: If Luther's accounts receivable were $55.5 million

Q46: Following the Sarbanes-Oxley Act in United States,Canadian

Q47: Why is the firm's statement of cash

Q65: A 30-year mortgage loan is a:<br>A)long-term liability.<br>B)current