Multiple Choice

Use the information for the question(s) below.

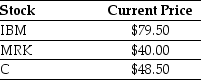

An exchange traded fund (ETF) is a security that represents a portfolio of individual stocks. Consider an ETF for which each share represents a portfolio of two shares of International Business Machines (IBM) , three shares of Merck (MRK) , and three shares of Citigroup Inc. (C) . Suppose the current market price of each individual stock are shown below:

-Suppose that the ETF is trading for $424.50; you should

A) sell the ETF and buy 2 shares of IBM, 3 shares of MRK, and 3 shares of C.

B) sell the ETF and buy 3 shares of IBM, 2 shares of MRK, and 3 shares of C.

C) buy the ETF and sell 2 shares of IBM, 3 shares of MRK, and 3 shares of C.

D) do nothing, no arbitrage opportunity exists.

Correct Answer:

Verified

Correct Answer:

Verified

Q60: You have an investment opportunity in the

Q68: A nominal interest rate is normally composed

Q69: You are up late watching TV one

Q70: The Time Value of Money (TVM)is defined

Q71: A McDonald's Big Mac value meal consists

Q73: You are offered an investment opportunity in

Q74: Use the table for the question(s) below.<br>

Q75: Which of the following statements regarding arbitrage

Q76: Consider two securities,A & B.Suppose a third

Q88: Use the information for the question(s)below. <img