Essay

Use the information for the question(s) below.

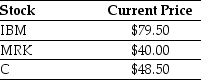

An exchange traded fund (ETF) is a security that represents a portfolio of individual stocks. Consider an ETF for which each share represents a portfolio of two shares of International Business Machines (IBM), three shares of Merck (MRK), and three shares of Citigroup Inc. (C). Suppose the current market price of each individual stock are shown below:

-Assume that the ETF is trading for $426.00.What (if any)arbitrage opportunity exists? What (if any)trades would you make?

Correct Answer:

Verified

Value of ETF = 2 × 79.50 + 3 ×...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: If the risk-free rate of interest (r<sub>f</sub>)is

Q2: You are offered an investment opportunity in

Q5: The first step in evaluating a project

Q6: Use the information for the question(s) below.<br>An

Q7: Use the table for the question(s) below.<br>

Q8: Use the information for the question(s) below.<br>An

Q9: Use the table for the question(s) below.<br>

Q10: If the risk-free rate of interest (r<sub>f</sub>)is

Q62: Suppose you will receive $500 in one

Q67: A project you are considering is expected