Multiple Choice

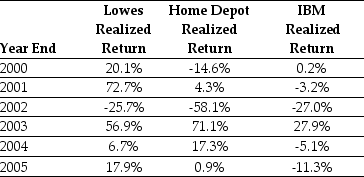

Use the table for the question(s) below.

Consider the following returns:

-The covariance between Lowes' and Home Depot's returns is closest to:

A) 0.10

B) 0.29

C) 0.12

D) 0.69

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q63: The efficient portfolio provides the benchmark that

Q64: Which of the following statements is false?<br>A)

Q65: The risk of a portfolio depends on

Q66: Which of the following statements is false?<br>A)

Q67: Suppose over the next year Ball has

Q69: Which of the following statements is false?<br>A)

Q70: Use the information for the question(s) below.<br>You

Q71: Which of the following statements is false?<br>A)

Q73: CAPM states that the investment's expected return

Q83: Use the table for the question(s)below.<br>Consider the