Multiple Choice

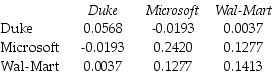

Use the table for the question(s) below.

Consider the following covariances between securities:

-The variance on a portfolio that is made up of a $6,000 investment in Duke Energy stock and a $4,000 investment in Wal-Mart stock is closest to:

A) 0.050

B) 0.045

C) 0.051

D) -0.020

Correct Answer:

Verified

Correct Answer:

Verified

Q34: Use the information for the question(s)below.<br>Suppose that

Q73: CAPM states that the investment's expected return

Q74: Suppose over the next year Ball has

Q75: Which of the following statements is false?<br>A)

Q76: Which of the following equations is incorrect?<br>A)

Q77: Use the table for the question(s) below.<br>Consider

Q79: Which of the following statements is false?<br>A)

Q81: Which of the following statements is false?<br>A)

Q82: Which of the following statements is false?<br>A)

Q83: The beta of a security measures its