Multiple Choice

Use the tables for the question(s) below.

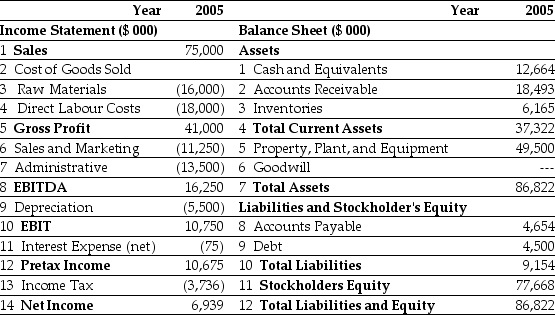

Estimated 2005 Income Statement and Balance Sheet Data for Ideko Corporation

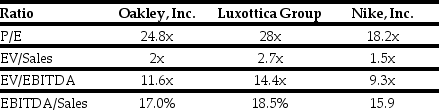

The following are financial ratios for three comparable companies:

The following are financial ratios for three comparable companies:

-Based upon the average EV/Sales ratio of the comparable firms,if Ideko holds $6.5 million of cash in excess of its working capital needs,then Ideko's target market value of equity is closest to:

A) $165 million

B) $157 million

C) $193 million

D) $191 million

E) $155 million

Correct Answer:

Verified

Correct Answer:

Verified

Q10: With the proper changes it is believed

Q25: Use the table for the question(s)below.<br>Capital Structure

Q31: Use the tables for the question(s)below.<br>Estimated 2005

Q34: Use the tables for the question(s) below.<br>Estimated

Q37: Using the income statement above and the

Q38: Use the table for the question(s)below.<br>Capital Structure

Q42: With the proper changes it is believed

Q42: The cash multiple does not depend on

Q43: Use the tables for the question(s) below.<br>Pro

Q48: Assuming that Ideko has a EBITDA multiple