Multiple Choice

Use the table for the question(s) below.

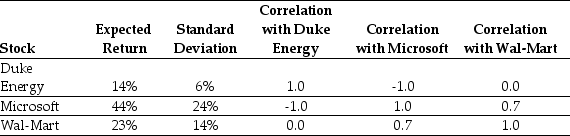

Consider the following expected returns,volatilities,and correlations:

-Consider a portfolio consisting of only Duke Energy and Microsoft.The percentage of your investment (portfolio weight) that you would place in Duke Energy stock to achieve a risk-free investment would be closest to:

A) 15%

B) 40%

C) 23%

D) 10%

Correct Answer:

Verified

Correct Answer:

Verified

Q21: Use the table for the question(s)below.<br>Consider the

Q24: Use the information for the question(s)below.<br>Suppose you

Q26: Use the information for the question(s)below.<br>Suppose you

Q29: Use the following information to answer the

Q57: Which of the following statements is FALSE?<br>A)The

Q58: Use the information for the question(s)below.<br>Suppose you

Q110: Use the information for the question(s)below.<br>Suppose you

Q111: Use the table for the question(s)below.<br>Consider the

Q114: Use the information for the question(s)below.<br>Suppose you

Q127: Which of the following statements is FALSE?<br>A)The