Multiple Choice

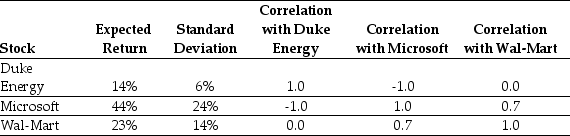

Use the table for the question(s) below.

Consider the following expected returns,volatilities,and correlations:

-Which of the following statements is FALSE?

A) The Sharpe ratio measures the ratio of volatility-to-reward provided by a portfolio.

B) Borrowing money to invest in stocks is referred to as buying stocks on margin.

C) The Sharpe ratio is the number of stand deviations the portfolio's return would have to fall to under-perform the risk-free investment.

D) The slope of the line through a given portfolio is often referred to as the Sharpe ratio of the portfolio.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Use the information for the question(s)below.<br>Tom's portfolio

Q24: Use the following information to answer the

Q42: Use the following information to answer the

Q63: Which of the following statements is FALSE?<br>A)The

Q63: Use the table for the question(s)below.<br>Consider the

Q67: Use the table for the question(s)below.<br>Consider the

Q69: Use the table for the question(s)below.<br>Consider the

Q70: Use the information for the question(s)below.<br>Tom's portfolio

Q113: Use the following information to answer the

Q128: Use the following information to answer the