Multiple Choice

Use the table for the question(s) below.

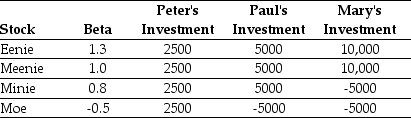

Consider the following three individuals portfolios consisting of investments in four stocks:

-Assuming that the risk-free rate is 4% and the expected return on the market is 12%,then required return on Peter's Portfolio is closest to:

A) 10%

B) 12%

C) 9%

D) 8%

Correct Answer:

Verified

Correct Answer:

Verified

Q31: Which of the following statements is FALSE?<br>A)While

Q46: Use the table for the question(s)below.<br>Consider the

Q89: Use the table for the question(s)below.<br>Consider the

Q102: Use the information for the question(s)below.<br>Sisyphean industries

Q121: Use the information for the question(s)below.<br>You are

Q121: Which of the following statements is FALSE?<br>A)Stock

Q122: Use the table for the question(s)below.<br>Consider the

Q123: Which of the following statements is FALSE?<br>A)Without

Q128: Use the following information to answer the

Q129: Use the table for the question(s)below.<br>Consider the