Essay

Meric Corporation (a U.S.company)began operations on January 1,2011,when the owner borrowed $150,000 to start the company.In the first month of operations,Meric had the following transactions:

January 3,2011 Bought inventory for 100,000 Brazilian real on account.Must be paid with Brazilian real.

January 8,2011 Sold 60% of inventory acquired on 1/3/11 for 32,000 British pounds on account.Invoice denominated in British pounds.

January 10,2011 Paid $3,000 in other operating expenses

January 23,2011 Acquired and paid half of the Brazilian real owed to the Brazilian supplier

January 28,2011 Collected half of the 32,000 pounds from the customer in Great Britain and immediately converted them into U.S.dollars

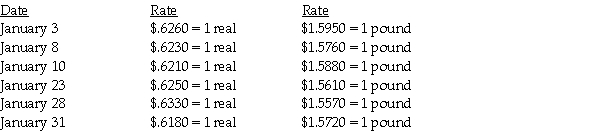

The following exchange rates apply:

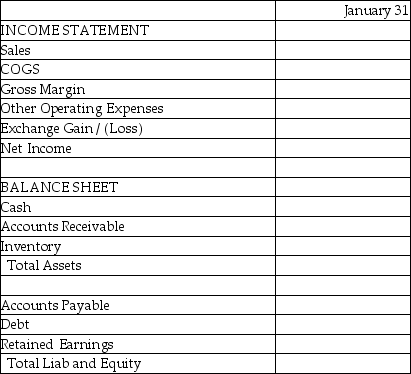

Required: Complete the summary income statement and balance sheet for the month ended January 31,2011 assuming there were no other transactions.

Required: Complete the summary income statement and balance sheet for the month ended January 31,2011 assuming there were no other transactions.

Correct Answer:

Verified

Correct Answer:

Verified

Q28: Use the following information to answer the

Q30: On October 15,2011,Napole Corporation,a French company,ordered merchandise

Q32: Lincoln Corporation,a U.S.manufacturer,both imports needed materials and

Q33: Jefferson Company entered into a forward contract

Q34: Cass Corporation's balance sheet at December 31,2011

Q35: A review of Ace Industries,a U.S.corporation,shows the

Q36: On May 1,2011,Deerfield Corporation purchased merchandise from

Q37: Johnson Corporation (a U.S.company)began operations on December

Q40: In September of 2011,Gunny Corporation anticipates that

Q44: When the billing for a U.S.company's sale