Essay

PreBuild Manufacturing acquired 100% of Shoding Industries common stock on January 1,2010,for $670,000 when the book values of Shoding's assets and liabilities were equal to their fair values and Shoding's stockholders' equity consisted of $380,000 of Capital Stock and $290,000 of Retained Earnings.

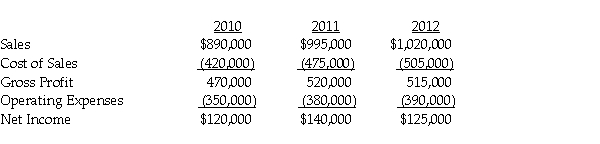

PreBuild's separate income (excluding investment income from Shoding)was $870,000,$830,000 and $960,000 in 2010,2011 and 2012,respectively.PreBuild sold inventory to Shoding during 2010 at a gross profit of $50,000 and 50% remained at Shoding at the end of the year.The remaining 50% was sold in 2011.At the end of 2011,PreBuild has $54,000 of inventory received from Shoding from a sale of $180,000 which cost Shoding $150,000.There are no unrealized profits in the inventory of PreBuild or Shoding at the end of 2012.PreBuild uses the equity method in its separate books.Select financial information for Shoding follows:

Required:

Required:

Prepare a schedule to determine PreBuild Manufacturing's Consolidated net income for 2010,2011,and 2012.

Correct Answer:

Verified

Correct Answer:

Verified

Q20: The material sale of inventory items by

Q24: A(n)_ sale is a sale by a

Q25: Use the following information to answer the

Q26: Use the following information to answer the

Q27: Use the following information to answer the

Q30: Use the following information to answer the

Q31: Use the following information to answer the

Q32: Use the following information to answer the

Q33: Use the following information to answer the

Q34: Psalm Enterprises owns 90% of the outstanding