Essay

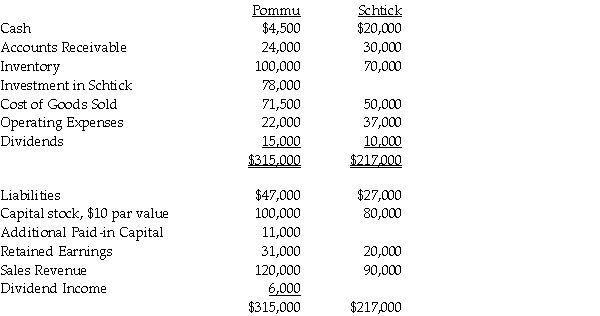

Pommu Corporation paid $78,000 for a 60% interest in Schtick Inc.on January 1,2011,when Schtick's Capital Stock was $80,000 and its Retained Earnings $20,000.The fair values of Schtick's identifiable assets and liabilities were the same as the recorded book values on the acquisition date.Trial balances at the end of the year on December 31,2011 are given below:

During 2011,Pommu made only two journal entries with respect to its investment in Schtick.On January 1,2011,it debited the Investment in Schtick account for $78,000 and on November 1,2011,it credited Dividend Income for $6,000.

During 2011,Pommu made only two journal entries with respect to its investment in Schtick.On January 1,2011,it debited the Investment in Schtick account for $78,000 and on November 1,2011,it credited Dividend Income for $6,000.

Required:

1.Prepare a consolidated income statement and a statement of retained earnings for Pommu and Subsidiary for the year ended December 31,2011.

2.Prepare a consolidated balance sheet for Pommu and Subsidiary as of December 31,2011.

Correct Answer:

Verified

Requirement 1:

_TB1...

_TB1...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q15: Use the following information to answer question(s)

Q21: On December 31,2010,Patenne Incorporated purchased 60% of

Q22: Parakeet Company has the following information collected

Q24: On January 2,2011,PBL Enterprises purchased 90% of

Q28: Platt Corporation paid $87,500 for a 70%

Q29: Pull Incorporated and Shove Company reported summarized

Q29: Which of the following statements is not

Q30: Parrot Corporation acquired 90% of Swallow Co.on

Q42: A parent company uses the equity method

Q44: Which one of the following will increase