Essay

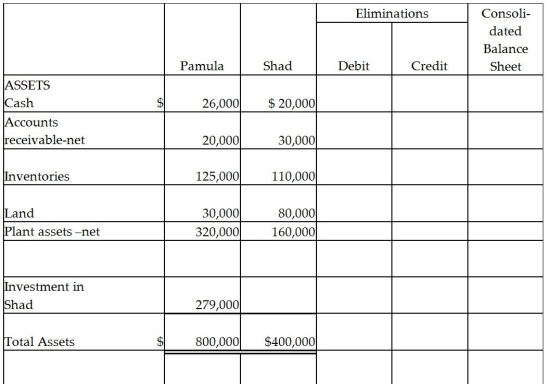

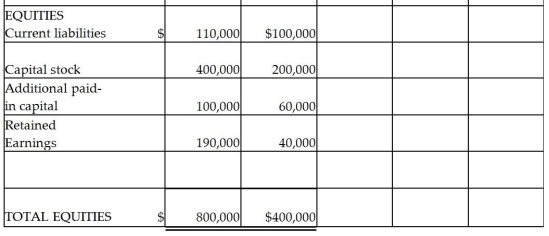

Pamula Corporation paid $279,000 for 90% of Shad Corporation's $10 par common stock on December 31,2011,when Shad Corporation's stockholders' equity was made up of $200,000 of Common Stock,$60,000 Additional Paid-in Capital and $40,000 of Retained Earnings.Shad's identifiable assets and liabilities reflected their fair values on December 31,2011,except for Shad's inventory which was undervalued by $5,000 and their land which was undervalued by $2,000.Balance sheets for Pamula and Shad immediately after the business combination are presented in the partially completed working papers.

Required:

Required:

Complete the consolidated balance sheet working papers for Pamula Corporation and Subsidiary.

Correct Answer:

Verified

Preliminary computat...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: In the preparation of consolidated financial statements,which

Q12: In the consolidated income statement of Wattlebird

Q13: Panini Corporation owns 85% of the outstanding

Q20: On January 1,2012,Packaging International purchased 90% of

Q22: Park Corporation paid $180,000 for a 75%

Q24: On July 1,2011,Polliwog Incorporated paid cash for

Q27: Pool Industries paid $540,000 to purchase 75%

Q28: On January 1,2011,Pinnead Incorporated paid $300,000 for

Q29: From the standpoint of accounting theory,which of

Q29: Pental Corporation bought 90% of Sedacor Company's