Multiple Choice

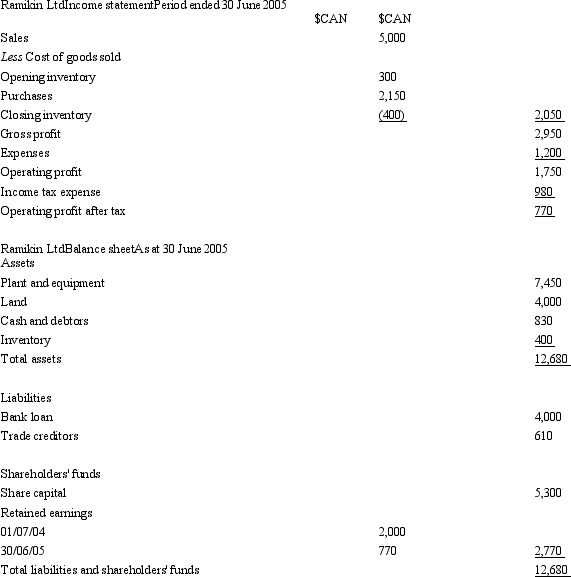

Ramikin Co is a fully owned subsidiary of Bobbin Ltd,an Australian company.Bobbin Ltd purchased all the issued capital of Ramikin Ltd on 1 July 2004.Ramikin Ltd is based in Canada.The following information is summarised from the foreign currency accounts of Ramikin Ltd for the period ended 30 June 2005.  Additional information:

Additional information:

All revenues and expenses were earned or incurred evenly throughout the year.

Inventory was purchased evenly over the period,with the inventory on hand at the end of the period purchased over the quarter ending on 30 June and trade creditors were accrued evenly over the period.

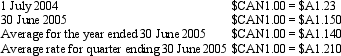

Exchange rate information: Based on the information provided.What is the gain (loss) on foreign currency translation for Ramikin Ltd for the period?

Based on the information provided.What is the gain (loss) on foreign currency translation for Ramikin Ltd for the period?

A) Gain $A385

B) Loss $A28

C) Loss $A612

D) Gain $A376

E) None of the given answers.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Under the translation method required by AASB

Q3: The 'spot rate' is:<br>A) The rate for

Q4: As prescribed in AASB 121,when re-measuring financial

Q5: Emu Co Ltd purchased a foreign operation

Q8: Under the translation method required by AASB

Q10: When translating the financial statements of a

Q12: In the process of consolidating the translated

Q25: As prescribed in AASB 121,in translating the

Q36: On the disposal of a foreign operation,AASB

Q40: When consolidating financial statements of foreign operations,we