Multiple Choice

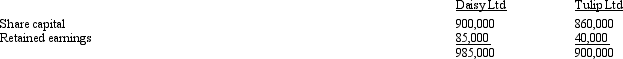

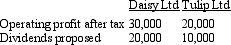

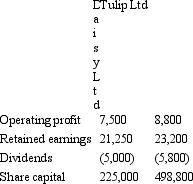

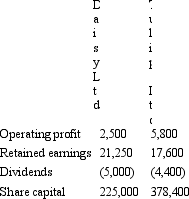

Rose Ltd acquired a 75 per cent interest in Daisy Ltd on 1 July 2004 for a cash consideration of $758,000.On the same date,Daisy Ltd acquired a 56 per cent interest in Tulip Ltd for a cash consideration of $534,000.The fair value of the net assets of each of the companies at acquisition is as follows:  Goodwill has been determined not to have been impaired.Information for the period ended 30 June 2005 for Daisy and Tulip is as follows:

Goodwill has been determined not to have been impaired.Information for the period ended 30 June 2005 for Daisy and Tulip is as follows: Neither dividend had been paid at the end of the period.There were no other intragroup transactions during the period.What is the minority interest in Daisy and Tulip as at 30 June 2005?

Neither dividend had been paid at the end of the period.There were no other intragroup transactions during the period.What is the minority interest in Daisy and Tulip as at 30 June 2005?

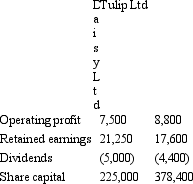

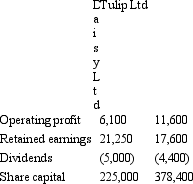

A)

B)

C)

D)

E) None of the given answers.

Correct Answer:

Verified

Correct Answer:

Verified

Q14: The following acquisition analysis relates to a

Q15: Non-sequential acquisition is when a parent acquires

Q16: The following diagram represents the ownership of

Q17: Pasta Ltd acquired an 80 per cent

Q18: The non-controlling interest in post-acquisition movement in

Q20: In calculating indirect minority interests,intragroup transactions need

Q21: The following is an extract from the

Q22: The following diagram represents the ownership of

Q23: A Ltd owns 85 per cent of

Q24: A Ltd owns 80 per cent of