Multiple Choice

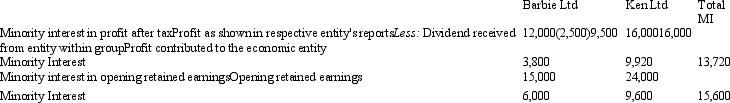

The following is an extract from the minority interest memorandum,used to calculate minority interests.Both subsidiaries became members of the economic entity at the same time at the start of this current period.  The line item 'Dividend received from entity within the group' is an adjustment made:

The line item 'Dividend received from entity within the group' is an adjustment made:

A) to prevent double-counting as the indirect minority interest of Barbie Ltd is in fact the same interest as the direct minority interest in Ken Ltd; and would have already received a share of the dividend as part of the share of profit in Ken Ltd.

B) to recognise, and eliminate, the dividend paid by Barbie Ltd directly to the parent entity.

C) to prevent double-counting as the indirect minority interest of Ken Ltd is in fact the same interest as the direct minority interest in Barbie Ltd; and would have already received a share of the dividend as part of the share of profit in Ken Ltd

D) to recognise, and eliminate, the dividend paid by Ken Ltd directly to the parent entity.

E) None of the given answers.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Jabba Ltd acquired a 70 per cent

Q9: Which of the following statements are incorrect?<br>A)

Q10: Jabba Ltd acquired a 70 per cent

Q11: A Ltd owns 80 per cent of

Q12: It is not possible for one entity

Q14: The following acquisition analysis relates to a

Q15: Non-sequential acquisition is when a parent acquires

Q16: The following diagram represents the ownership of

Q17: Pasta Ltd acquired an 80 per cent

Q18: The non-controlling interest in post-acquisition movement in