Multiple Choice

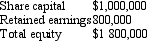

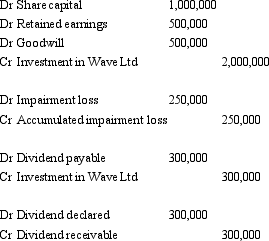

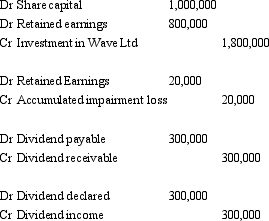

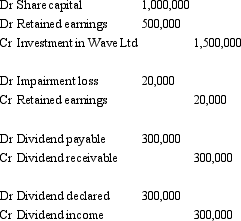

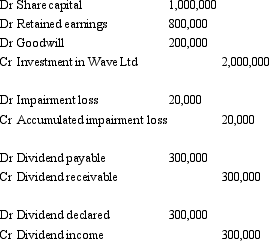

Radio Ltd acquired all the issued capital of Wave Ltd on 1 July 2004 for cash consideration of $2 million.The fair value of the net assets of Wave Ltd at that date was $1.8 million as follows:  During the period ending 30 June 2005 Wave Ltd declare a dividend of $300,000 that is identified as being paid out of pre-acquisition profits.Goodwill had been determined to have impaired by $20,000 during the period.What consolidation journal entries would be required to prepare group accounts for the period ended 30 June 2005?

During the period ending 30 June 2005 Wave Ltd declare a dividend of $300,000 that is identified as being paid out of pre-acquisition profits.Goodwill had been determined to have impaired by $20,000 during the period.What consolidation journal entries would be required to prepare group accounts for the period ended 30 June 2005?

A)

B)

C)

D)

E) None of the given answers.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Little Company declared a dividend of $90,000

Q2: Hammer Ltd acquired all the issued capital

Q6: Penny Ltd sells inventory items to its

Q7: Intragroup transactions that are to be eliminated

Q8: Large Company owns 80 per cent of

Q9: The journal entries to eliminate unrealised profit

Q11: Examples of intragroup transactions include:<br>A) Dividends payable

Q12: The value of inventory on hand for

Q14: Companies in an economic entity may increase

Q54: If a subsidiary makes a dividend payment