Multiple Choice

Zeus Ltd owns 100 per cent of the issued capital of Ares Ltd.On 1 July 2005 Zeus Ltd purchased an item of equipment from Ares Ltd for $800,000.Ares had owned the equipment for 2 years.It originally cost $890,000 and the accumulated depreciation was $178,000 at the time of sale.The equipment has been depreciated over this time,but not written down or revalued.The remaining useful life of the equipment at 1 July 2005 is estimated to be 8 years.Zeus Ltd expects the benefits to be obtained from the equipment to be evenly received over its useful life.The tax rate is 30 per cent. What are the consolidation journal entries required for this inter-company transaction for the period ended 30 June 2006?

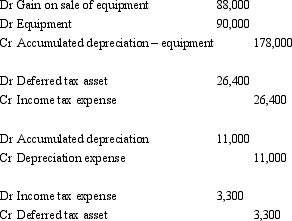

A)

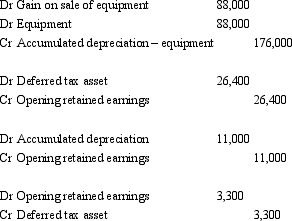

B)

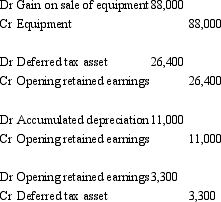

C)

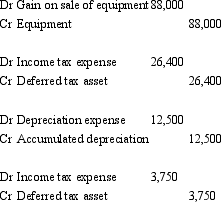

D)

E) None of the given answers.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Dividends may be identified as being paid

Q31: French Ltd purchased 100 per cent of

Q32: Companies A,B and C are all part

Q33: Companies A,B and C are all part

Q34: French Ltd owns 100 per cent of

Q34: The level of equity ownership is not

Q37: Alice Ltd sold inventory items to its

Q38: Meat Ltd purchased 100 per cent of

Q39: Company A owns 51 per cent of

Q58: Intragroup sales of non-current assets results in