Multiple Choice

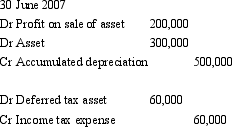

A non-current asset was sold by Subsidiary Limited to Parent Limited on 30 June 2007.The carrying amount of the asset at the time of the sale was $700,000.As part of the consolidation process,the following journal entry was passed.  Assuming there is another ten years of useful life remaining for the asset,what are the journal entries at 30 June 2009 to adjust for depreciation?

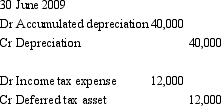

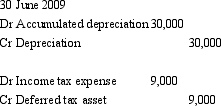

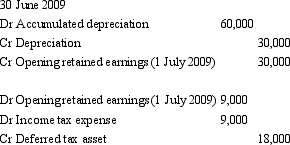

Assuming there is another ten years of useful life remaining for the asset,what are the journal entries at 30 June 2009 to adjust for depreciation?

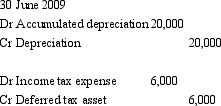

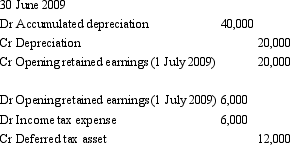

A)

B)

C)

D)

E)

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Intragroup profits are eliminated in consolidation to

Q19: Dividends paid between entities in the group

Q21: What is the amount of unrealised profit

Q22: A non-current asset was sold by Subsidiary

Q23: The fact that consolidation worksheets start "afresh"

Q25: AASB 127 "Consolidated and Separate Financial Statements"

Q27: Woody Ltd sold inventory items to its

Q28: What is the amount of unrealised profit

Q29: Which of the following statements describes the

Q38: Parent Ltd sells inventories to Child Ltd