Multiple Choice

Gingimup Ltd purchased all the equity of Kindawansa Ltd on 30 June 2005.At that time the carrying value of the net assets of Kindawansa was $1,200,000.This amount was made up in equity as follows: share capital $1,000,000; retained earnings $200,000.Kindawansa has held some valuable land for a long time (purchased at $ 1,200,000) ,but has not revalued it.Its fair value at 30 June 2005 was $2,800,000 (all other non-current assets are recorded at fair value) .Gingimup Ltd paid cash consideration of $3,000,000 for Kindawansa Ltd.Assuming that the land has not been revalued in the controlled entity's books,what are the elimination entries required to reflect the purchase of Kindawansa Ltd?

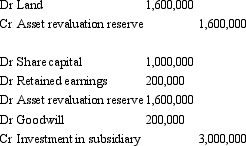

A)

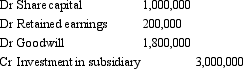

B)

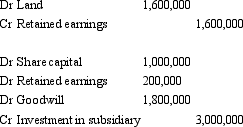

C)

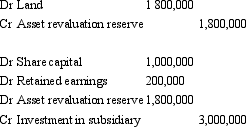

D)

E) None of the given answers.

Correct Answer:

Verified

Correct Answer:

Verified

Q59: Control is defined in AASB 3 as

Q60: Which of the following statements is not

Q61: Minority interests (minority interests)are defined as the

Q62: The lack of a direct link between

Q63: Fresco Ltd acquires all the issued capital

Q65: In the situation in which a subsidiary

Q66: Richer Ltd is owed a material amount

Q67: In the situation in which a subsidiary

Q68: The partition effect in relation to a

Q69: In determining control,'potential voting rights':<br>A) include those