Multiple Choice

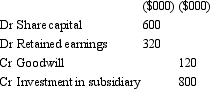

On 1 July 2012,Goliath Ltd acquires all shares in David Ltd for $800 000.The fair value of net assets acquired is $920 000 comprised of $600,000 in share capital and $320 000 in retained earnings.What is the appropriate elimination entry for this investment that is in accordance with AASB 3 "Business Combinations" and AASB 127 "Consolidated and Separate Financial Statements"?

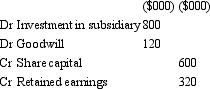

A)

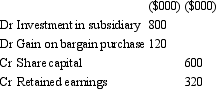

B)

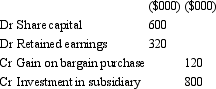

C)

D)

E) None of the given answers.

Correct Answer:

Verified

Correct Answer:

Verified

Q19: Where the controlled entity's non-current assets were

Q20: After initial recognition,goodwill is measured in which

Q21: AASB 127 notes that in preparing consolidated

Q22: Jasper Ltd acquires all the issued capital

Q23: When an acquirer makes a bargain purchase

Q25: Minority interests are defined is AASB 127

Q26: AASB 127 defines control as:<br>A) Governing the

Q27: What are the major consolidation concepts?<br>A) Entity,

Q29: Which of the following statements accurately describes

Q86: Sullivan (1985)argued that the preparation of group