Multiple Choice

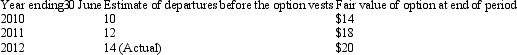

Winton Ltd grants 100 options to each of its 50 employees on 1 July 2009.Each grant is conditional on the employee working for the company for 3 years.The fair value of each option at grant date is $15. The following information is available: What is the employee benefits expense of Winton Ltd related to this share option for the year ended 30 June 2010,2011 and 2012,respectively?

What is the employee benefits expense of Winton Ltd related to this share option for the year ended 30 June 2010,2011 and 2012,respectively?

A) $18 667; 26 933; 26 400;

B) $20 000; 20 000; 20 000;

C) $20 000, $18 000; $16,000;

D) $26 667; $24 000; $21 333;

E) None of the given answers

Correct Answer:

Verified

Correct Answer:

Verified

Q27: AASB 2 requires the remeasurement of cash-settled

Q35: What is the Employee benefits expense of

Q35: Equity instruments granted to employees of the

Q36: Which of the following is an acceptable

Q38: AASB 2 requires the re-measurement of equity-settled

Q39: Which of the following share-based payment transactions

Q40: Market prices for share options granted to

Q55: Issue of shares in exchange for shares

Q62: AASB 2 requires all share-based payment transactions

Q66: AASB 2 requires some share-based payments to