Multiple Choice

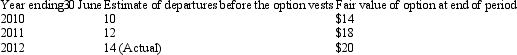

Longreach Ltd grants 100 options to each of its 50 employees on 1 July 2009.Each grant is conditional on the employee working for the company for 3 years.The fair value of each option at grant date is $15. The following information is available: What is the employee benefits expense of Longreach Ltd related to this share option for the year ended 30 June 2010?

What is the employee benefits expense of Longreach Ltd related to this share option for the year ended 30 June 2010?

A) $18 667;

B) 20 000;

C) $26 667;

D) $56 000;

E) $60 000

Correct Answer:

Verified

Correct Answer:

Verified

Q7: If share appreciation rights vest immediately,the entity

Q11: Which of the following share-based payment transactions

Q12: What would be the appropriate journal entry

Q13: AASB 2 requires all share-based payment transactions

Q15: If the arrangement in a share-based transaction

Q17: On 1 July 2009 Chester Ltd granted

Q18: On 30 June 2011,based on probability estimates

Q19: In accordance with AASB 2,how much Employee

Q21: What is/are the journal entry(ies)to recognise salary

Q50: AASB 2 requires all share-based payment transactions