Multiple Choice

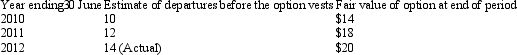

Penneshaw Ltd grants 100 options to each of its 50 employees on 1 July 2009.Each grant is conditional on the employee working for the company for 3 years.The fair value of each option at grant date is $15. The following information is available: What is the employee benefits expense of Penneshaw Ltd related to this share option for the year ended 30 June 2012?

What is the employee benefits expense of Penneshaw Ltd related to this share option for the year ended 30 June 2012?

A) $16 000;

B) $20 000;

C) $21 333;

D) $26 400;

E) None of the given answers

Correct Answer:

Verified

Correct Answer:

Verified

Q10: In a cash-settled share-based payment transaction,the entity

Q39: In share-based payment transactions with cash alternatives,the

Q50: On 30 June 2010,based on probability estimates

Q51: On 1 July 2009,Manchester Ltd granted 50,000

Q52: What is the journal entry to recognise

Q53: A share-based payment is a transaction which

Q54: What action must Wigan Ltd take that

Q57: What would be the appropriate journal entry

Q58: What is/are the journal entry/ies to recognise

Q59: On 30 June 2012,based on probability estimates