Multiple Choice

Burchells Ltd owns a machine that originally cost $36,000.It has been depreciated using the straight-line method for 3 years,giving an accumulated depreciation of $15,000 (the salvage value was estimated at $6,000 and the useful life at 6 years) .At the beginning of the current financial year its carrying value is therefore $21,000.It has been decided by the directors to revalue it to fair value,which is assessed to be $38,000.The salvage value and useful life are considered to be unchanged.What are the appropriate entries to record the revaluation and the depreciation expense for the current year (rounded to the nearest dollar) ?

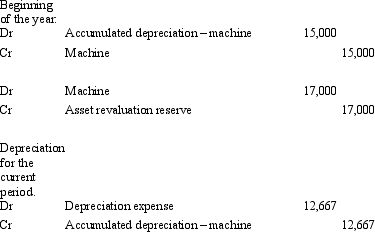

A)

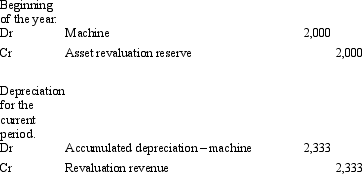

B)

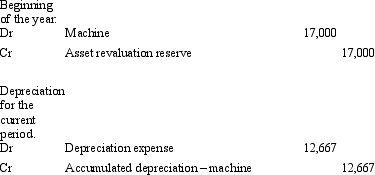

C)

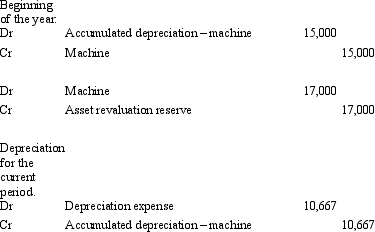

D)

E) None of the given answers.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Once an entity elects to value a

Q22: A machine purchased by White Ltd had

Q24: Which of the following statement is true

Q25: Where management's bonuses are tied to profit-based

Q27: Where there are debt covenants in place

Q29: According to Positive Accounting Theory,the size of

Q30: Casey Co Ltd is assessing the recoverable

Q34: If an asset is subject to depreciation

Q60: A sale of property plant and equipment

Q72: The concept of conservatism requires that if