Multiple Choice

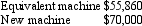

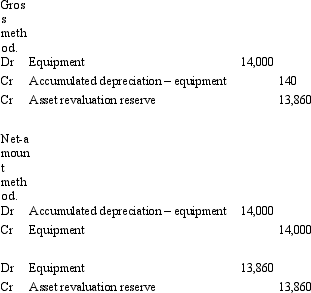

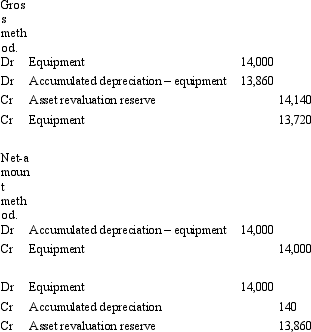

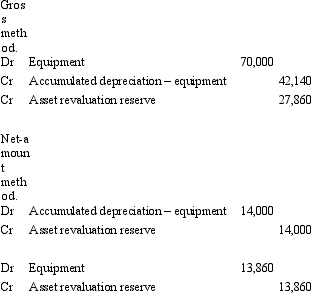

Smith & Jones Ltd owns equipment that was purchased for $56,000 and has accumulated depreciation of $14,000.The following market value information was gathered about the equipment:  The equipment has a remaining useful life to the entity of 10 years.What are the appropriate journal entries to record the revaluation under the gross method and the net-amount method?

The equipment has a remaining useful life to the entity of 10 years.What are the appropriate journal entries to record the revaluation under the gross method and the net-amount method?

A)

B)

C)

D)

E) None of the given answers.

Correct Answer:

Verified

Correct Answer:

Verified

Q49: Brahms Ltd acquired a property of land

Q50: Once a class of non-current assets has

Q52: AASB 116 prescribes that,if assets within the

Q53: Stairway Ltd is undertaking its regular review

Q54: Seagull Marinas Ltd owns land that was

Q55: Pigeon Ltd purchased land for $750,000 6

Q56: Chopin Ltd has a debt contract and

Q56: Recoverable amount is the amount expected to

Q57: Depreciation method used and depreciation rates are

Q58: A class of non-current assets as defined